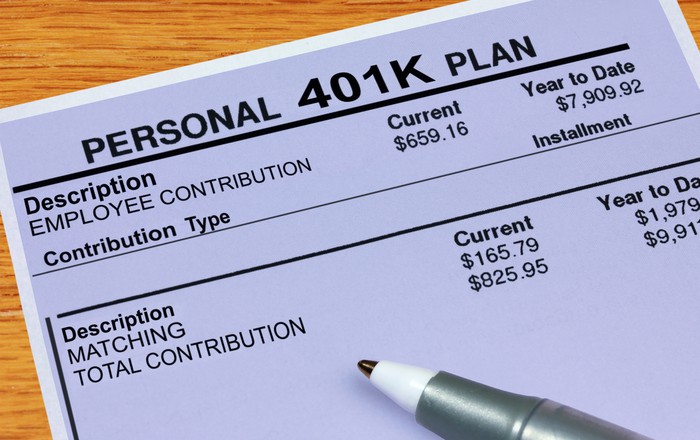

If your plan allows you to carry unused amounts into next year, the maximum you can carry over is $550. If you choose to set up a 401 (k) plan where employer matching is based on employee compensation, there are annual limits set in place. In 2021, you can save up to $2,750 in your health-care FSA – the same amount as 2020. The 401 (k) limits for these additional contributionsper year are: 2018: 6,000.

Meanwhile, health-care FSAs generally must be used by the end of the plan year. You can roll your HSA balance from one year into the next, accumulating cash you can use in retirement. Savers who are 55 and over can contribute another $1,000.īe aware that HSAs aren't the same as health-care flexible spending accounts (FSAs). 3 election These are the income tax brackets for 2021 Four ways wealthy families are trying to block bigger estate taxes under BidenĪccountholders with family plans can save up to $7,200 in this account, an increase from $7,100 in 2020.

More from Smart Tax Planning: 3 smart tax moves, no matter who wins the Nov. Next year, you can stash up to $3,600 if you're an individual with self-only health coverage, according to the IRS. That's different from your 401(k) contribution, which avoids income taxes at deferral but is subject to Social Security and Medicare tax. There's a sweetener to using the HSA at work: Contributions aren't subject to income, Social Security or Medicare taxes.

#MAX 401 CONTRIBUTION 2021 FREE#

You're able to tap the money free of taxes for qualified medical expenses. In this case, you save pretax or tax-deductible money into your HSA, where your funds grow tax-free. If you have a high-deductible health insurance plan next year, you might also have access to a health savings account. Personal Loans for 670 Credit Score or Lower Personal Loans for 580 Credit Score or Lower If your plan specifies that salary deferrals be based on a participant’s first $280,000 of compensation, then you must stop allowing Mary to make salary deferrals when her year-to-date compensation reaches $280,000, even though she hasn’t reached the annual $19,000 limit on salary deferrals, and must base the employer match on her actual deferrals.Best Debt Consolidation Loans for Bad Credit What does your plan say?Īlthough not common, a plan can specifically require that salary deferrals cease once a participant’s compensation reaches the annual limit. She must receive a matching contribution of $7,000 (50% x $14,000) under the terms of the plan. Although Mary makes salary deferrals of $19,000, only $14,000 (5% of $280,000) will be matched. Although Mary earned $360,000, your plan can only use up to $280,000 of her compensation when applying the matching formula for 2019. If your plan provides for matching contributions, you must follow the plan’s match formula.Įxample: Your plan requires a match of 50% on salary deferrals that do not exceed 5% of compensation. Mary may contribute to the plan until she reaches her annual deferral limit of $19,000 even though her compensation will exceed the annual limit of $280,000 in October.

0 kommentar(er)

0 kommentar(er)